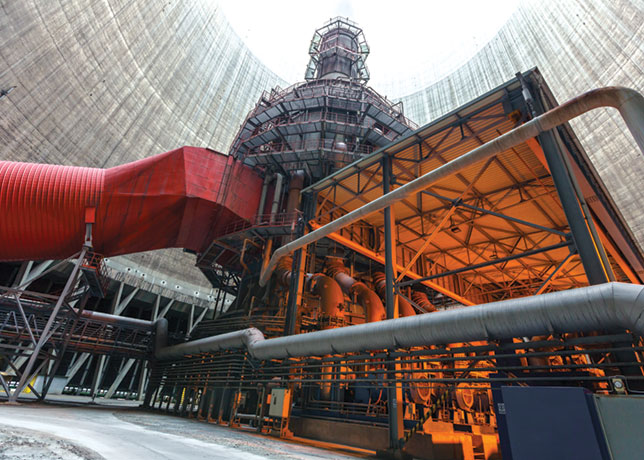

Naturgy is a key company in the Spanish energy system

Naturgy is a key company in the Spanish energy system

Taqa, an international energy and water company based in Abu Dhabi, UAE, is in talks with the three largest shareholders in Naturgy over a possible takeover of the Spanish energy company, newspaper Cinco Dias reported, citing unidentified market sources.

ADPower, a unit of Abu Dhabi sovereign wealth fund ADQ, owns just over 90 per cent of Taqa.

The negotiations, involving Spanish holding vehicle Criteria as well as private equity investment funds CVC and GIP, started over a month ago with the knowledge of the Spanish government, Cinco Dias said in its report.

Criteria, which is the main shareholder in lender Caixabank, owns a 26.7 per cent stake in Naturgy. GIP and CVC each own around a 20 per cent stake.

Taqa would have to launch a full takeover bid for the whole company, as Spanish legislation requires a mandatory tender offer when a buyer wants to acquire more than 30 per cent of any publicly traded company.

Angel Simon, Criteria CEO, told a business event in Madrid that the company aimed to "strengthen its presence in strategic Spanish companies in the banking, energy and water sectors".

A 40 per cent stake in Naturgy, which has a market value of €20.2 billion ($21.42 billion), according to LSEG data, is worth slightly more than €8 billion.

Naturgy shares were up around 5 per cent in morning trade in Madrid, while the broader market was down 1 per cent.

"This is a key company in the Spanish energy system and we want stability and commitment to decarbonisation and energy security," a spokesperson for Spain's Energy Ministry said.

Cinco Dias said its sources assumed that certain conditions would be imposed on Taqa in exchange for the Spanish government's approval of any deal.

Naturgy's main strategic assets are its gas contracts with Algeria, the report added.