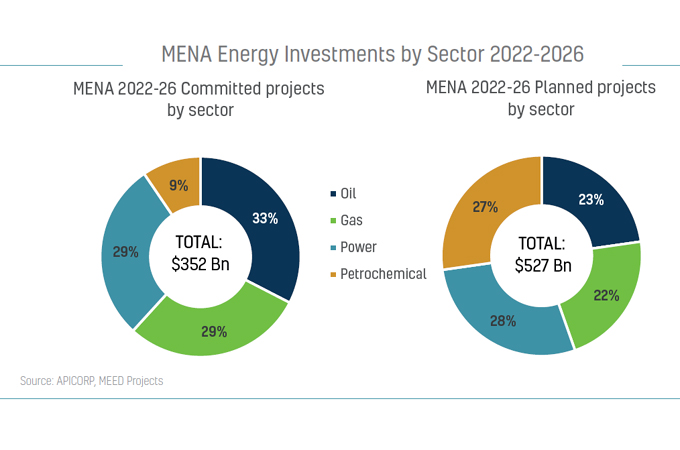

The total planned and committed energy investments in the MENA region are expected to increase by 9% to exceed $879 billion over the next five years, according to a study.

The MENA Energy Investment Outlook 2022-2026 released by the Arab Petroleum Investments Corporation (Apicorp), a multilateral financial institution, says projected investments are a $74 billion jump from the $805 billion estimated in last year’s five-year outlook.

Saudi Arabia leads the region in energy investments, followed by Iraq, Egypt and UAE, the report says.

The report notes that the Russia-Ukraine war has led to contrasting impacts on the region’s energy landscape, with net-energy exporters spearheading the increase in project expenditure thanks to the windfall of oil and gas revenues caused by the spike in prices driven by the war. However, global geopolitical volatility and macro headwinds are not curtailing oil, gas, power and petrochemicals investment growth in MENA for the upcoming five years, said the report.

In the GCC, committed projects comprise around 45% of total energy investments – 50% higher than the MENA-wide average of 30%. For net-energy importers in the North Africa and Levant regions, their relative vulnerability to geopolitical risks stemming from the war compounded by the economic strains of inflation and debt burdens are beginning to show and impact energy investments, it said.

Ramy Al-Ashmawy, Senior Energy Specialist at Apicorp, said: “Our latest MENA Energy Investment Outlook shows that the region continues to progress in its unique energy transition path. MENA countries shoulder the largest share of global investments in oil and gas going forward to ensure global energy security and avoid an impending super cycle that may severely hamper the world economy. At the same time, the region continues to invest in decarbonization, renewables and clean energy as part of the long-term strategic vision for a low-carbon future underpinned by a greener, more balanced, and sustainable energy mix.”

Blue and green hydrogen

Apicorp’s analysis shows that right across the region, blue and green hydrogen will dominate the emerging hydrogen markets in the near term. The report forecasts that hydrogen markets will start scaling up as the market foundations are established, and for the MENA region – GCC and North Africa specifically – the focus will be on exporting low-carbon hydrogen to demand centres in Europe and SE Asia via ammonia shipments.

Suhail Shatila, Senior Energy Specialist at Apicorp, said: “In the medium term, blue hydrogen proves to be a more attractive option to the MENA region. Blue hydrogen can be produced at a relatively low cost, and it will only slightly disrupt the IOC and NOC’s existing business models. This is a central metric in the energy transition journey since hydrocarbon producers will play a key role in decarbonizing the upstream oil and gas sector and help reach net-zero targets by mid-century.”

Energy Diversification

Energy diversification is at the top of the agenda, with several MENA countries integrating renewables in their generation mix as part of a shared policy objective to diversify the power mix with low-cost, low-carbon energy sources and bolster power supply security.

For hydrocarbon net-importing countries with robust renewables potential, the aim is to reduce dependence on conventional fuel imports and integrate low-cost renewables into domestic grids. Over the coming years, the priority for hydrocarbon net exporters is to free up export volumes of conventional fuels to maximize revenues at healthy price environments to fund socioeconomic development and support the decarbonization initiatives of their respective net-zero targets, the report points out.

Although few MENA countries have already pledged their net-zero targets (the UAE by 2050 and Saudi Arabia and Bahrain by 2060), electrification via renewable energy sources will be a key driver to reach those targets. However, due to the intermittency of renewable energy sources and the lack of utility-scale grid storage solutions to date, conventional fuels and nuclear will remain essential in the power supply mix.

Renewables growth

The MENA region is expected to add 5.6 GW of installed capacity from renewables in 2022, nearly double the 3 GW which came online in 2021. By 2026, the region is expected to add 33 GW by installed capacity of renewables, with around 26 GW as utility and distributed solar PV.

Leading the charge of meeting renewables policy targets in MENA are Morocco and Jordan. The two countries have achieved their short-term policy targets, with Morocco reaching almost 40% of its installed capacity from renewable energy in 2021 and Jordan reaching nearly 20%. Other countries such as Saudi Arabia, UAE, Egypt, and Oman have relatively low renewable energy generation, but the share is expected to witness a significant increase with several planned and committed large-capacity projects in the pipeline.

Power generation mix

Apicorp forecasts that of the energy vectors constituting the power mix in MENA, natural gas – which is already a dominant fuel for power generation – is expected to grow to maintain a power generation share of around 70% to 75% across MENA by 2024. Another positive sustainability signal oil-fired power, which is expected to drop from 24% of total generation to around 20% by 2024.

In Saudi Arabia, gas-fired generation is projected to rise in the upcoming five years, while oil-fired power output is expected to drop over the same period, whereby the share of oil-fired generation in the power mix is projected to drop to less than 30% in 2022 from an estimated 32% in 2021. In the UAE, natural gas constitutes around 90% of the power generation mix and is expected to drop to less than 60% in the next five years as the country diversifies its supply mix with nuclear and renewables.

Nuclear power generation in MENA remains relatively modest, comprising 3% of the total generation mix in 2021, led by the UAE. Egypt’s first planned nuclear power plant - the 4.8 GW ‘El Dabaa’ facility – is expected to come online in 2026. Saudi Arabia and Jordan also announced their intent to add nuclear energy to their power mix during this decade.

Regulations, financing

Apicorp’s analysis points out that oil and gas companies are facing tighter financing conditions and addressing evolving regulatory frameworks while trying to contribute to socio-economic development and the provision of affordable energy. Consequently, MENA governments continue to shoulder the main portion of hydrocarbon investments going forward to ensure the security of supply.

MENA equity markets in 2021 witnessed the return to healthy deal flow volumes in both conventional and renewable energy, given the region’s dual approach to the energy transition. It is expected that the strong regional privatisation drive will continue in 2022, with increased PPPs and IPOs unlocking value from world-class hydrocarbon assets while targeting synergies through PPPs.

MENA green and sustainability bonds issued in 2021 more than tripled compared to 2020 to $18.64 billion. 2021 also witnessed the birth of MENA’s first voluntary carbon trading scheme by the Saudi Stock Exchange (Tadawul), paving the way for the development of a formal carbon market for trading credits and offsets. Under the recent net-zero pledges of the UAE, KSA, and Bahrain, carbon markets are expected to flourish in the region as hydrocarbon, petrochemical and heavy industry producers will need carbon trading platforms to offset part of their emissions especially in the hard-to-abate industries. -TradeArabia News Service